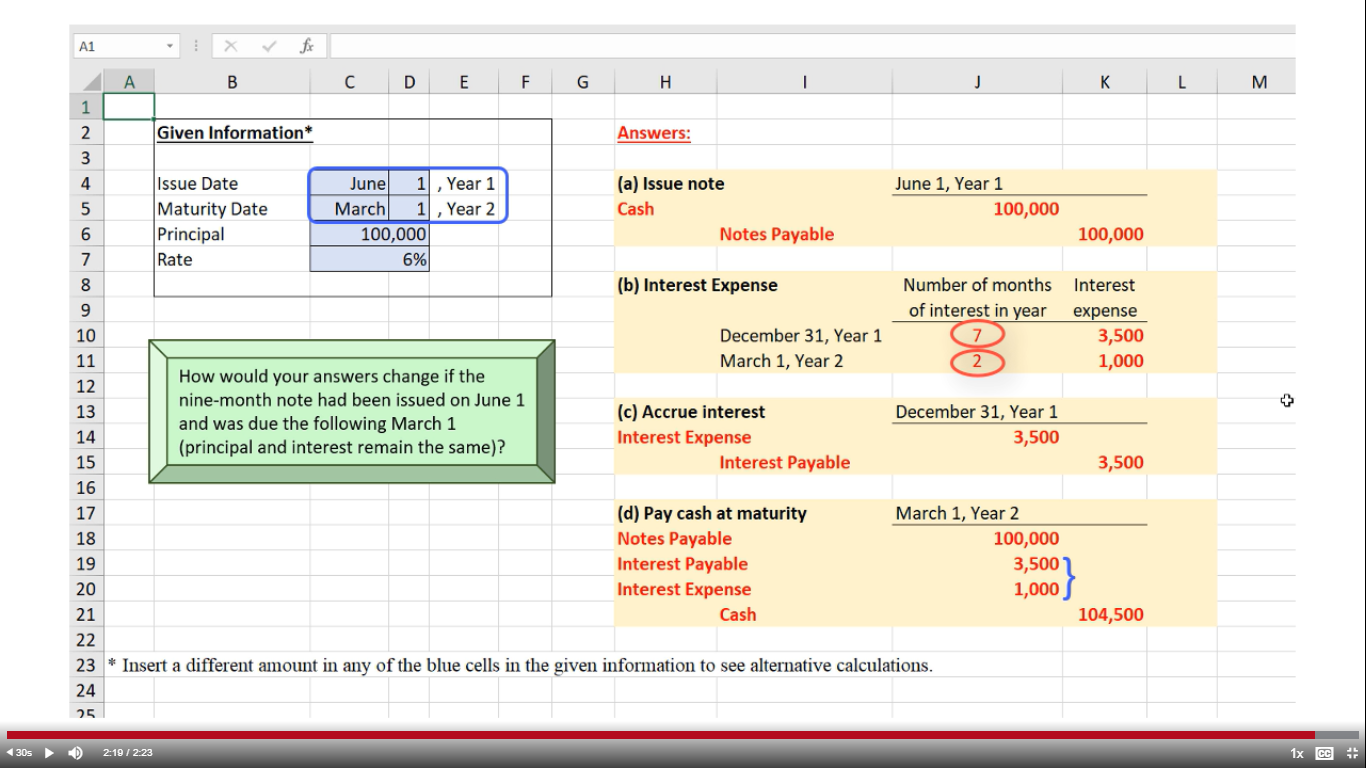

There are typically two methods of payment pattern on the notes payable. These are accrued interest plus equal principal payment and equal payments. Theoretically, the accounting for long-term notes payable is similar to the accounting for bonds payable.

Journal Entry Example of Common Account Types

On the other hand, short-term agreements are treated as current liabilities. This is not an exhaustive list of every journal entry example out there. It does serve as a good list of the most common ones, however, to help you get a basic understanding of making entries and postings. If you choose to do your own accounting, we encourage you to dig deeper into the different scenarios specific to your business. To help you work out different scenarios in your business, we’ve compiled a journal entry example for each common transaction.

Information shown on a Note Payable

Adjusting entries at the end of an accounting period ensures that financial statements accurately reflect the company’s financial position and performance. For example, you might adjust the balances of certain asset and liability accounts to reflect their current values. Sierra Sports requires a new apparel printing machine afterexperiencing an increase in custom uniform orders. Sierra does nothave enough cash on hand currently to pay for the machine, but thecompany does not need long-term financing.

Long-Term Notes Payable, Interest, and the Time Value of Money

F. Giant must pay the entire principal and, in the first case, the accrued interest. In both cases, the final month’s interest expense, $50, is recognized. Interest expense is not debited because interest is a function of time. The discount simply represents the total potential interest expense to be incurred if the note remains’ unpaid for the full 120 days. It would be inappropriate to record this transaction by debiting the Equipment account and crediting Notes Payable for $18,735 (i.e., the total amount of the cash out-flows). The cash amount in fact represents the present value of the notes payable and the interest included is referred to as the discount on notes payable.

In summary, both cases represent different ways in which notes can be written. In the first case, the firm receives a total face value of $5,000 and ultimately repays principal and interest of $5,200. At the end of the note’s term, all of these interest charges have been recognized, and so the balance in this discount account becomes zero. To accomplish this process, the Discount on Notes Payable account is written off over the life of the note.

Journal Entry Example for Small Business Owners

An interest-bearing note payable may also be issued on account rather than for cash. In this case, a company already owed for a product or service it previously was invoiced for on account. Rather than paying the account off on the due date, the company requests an extension and converts the accounts payable to a note payable. If a debtor runs into financial difficulties and is unable to pay, or fully repay, the note, the estimated impaired cash flows become an important reporting disclosure for the lender. If the lender can reasonably estimate the impaired cash flows an entry is made to record the debt impairment.

- This is due to the interest expense is the type of expense that incurs through the passage of time.

- To summarize, the present value (discounted cash flow) of $4,208.40 is the fair value of the $5,000 note at the time of the purchase.

- The note payable is a written promissory note in which the maker of the note makes an unconditional promise to pay a certain amount of money after a certain predetermined period of time or on demand.

- The long term-notes payable are classified as long term-obligations of a company because the loan obtained against them is normally repayable after one year period.

Based on the information provided by Empire Construction Ltd. management, the bank estimated that it was probable that it would receive only 75% of the 2023 balance at maturity. Secured notes payable identify collateral security in the form of assets belonging to the borrower that the creditor can seize if the note is not paid at the maturity date. Accounts payable are short-term credits that allow customers to pay for goods or services and be billed later; they are often undocumented and without interest.

This will be illustrated when non-interest-bearing long-term notes payable are discussed later in this chapter. As the length of time to maturity of the note increases, the interest component becomes increasingly more using intuit payroll to setup payment for nanny significant. As a result, any notes payable with greater than one year to maturity are to be classified as long-term notes and require the use of present values to estimate their fair value at the time of issuance.

Each account shows the debits and credits for that particular account. A journal entry is the first place where you record these transactions, in chronological order. You typically need to adjust entries when you see a difference between cash flow and the accrual basis of accounting. For example, you might pay for expenses in advance and adjust the prepaid expense account to reflect the portion used up during the period. Short-term debt may be preferred over long-term debt when theentity does not want to devote resources to pay interest over anextended period of time. In many cases, the interest rate is lowerthan long-term debt, because the loan is considered less risky withthe shorter payback period.

He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. All these components play a vital role in making appropriate journal entries.